Helping you make better technology decisions

Expert research about what really matters when buying and selling broadcast and media technology.

Who we help

We help broadcast and media technology vendors and buyers navigate a complex market. We know the industry inside out and care about helping everyone be more successful. Better information enables faster and lower-risk technology decisions.

Buyers identify the most-innovative technology products that best fit their needs. Vendors pinpoint the addressable market for their products and how best to sell them.

Caretta Portal provides the industry’s authoritative source of data on the broadcast and media technology market including detailed market sizing and forecasts, plus market shares and growth for individual vendors. Caretta Go-to-Market drives sales by identifying buyer needs, cohorts and individual decision-makers. Caretta Consulting provides expert advisory on product strategy, competitors, sales enablement, and for buyers, the industry’s only independent and completely neutral support for successful media tech procurement.

Product go-to-market

Delivering clear, actionable recommendations to sharpen product positioning and messaging. Mapping to buyers’ real-world needs, pain points, technology preferences and investment drivers.

Competitor information

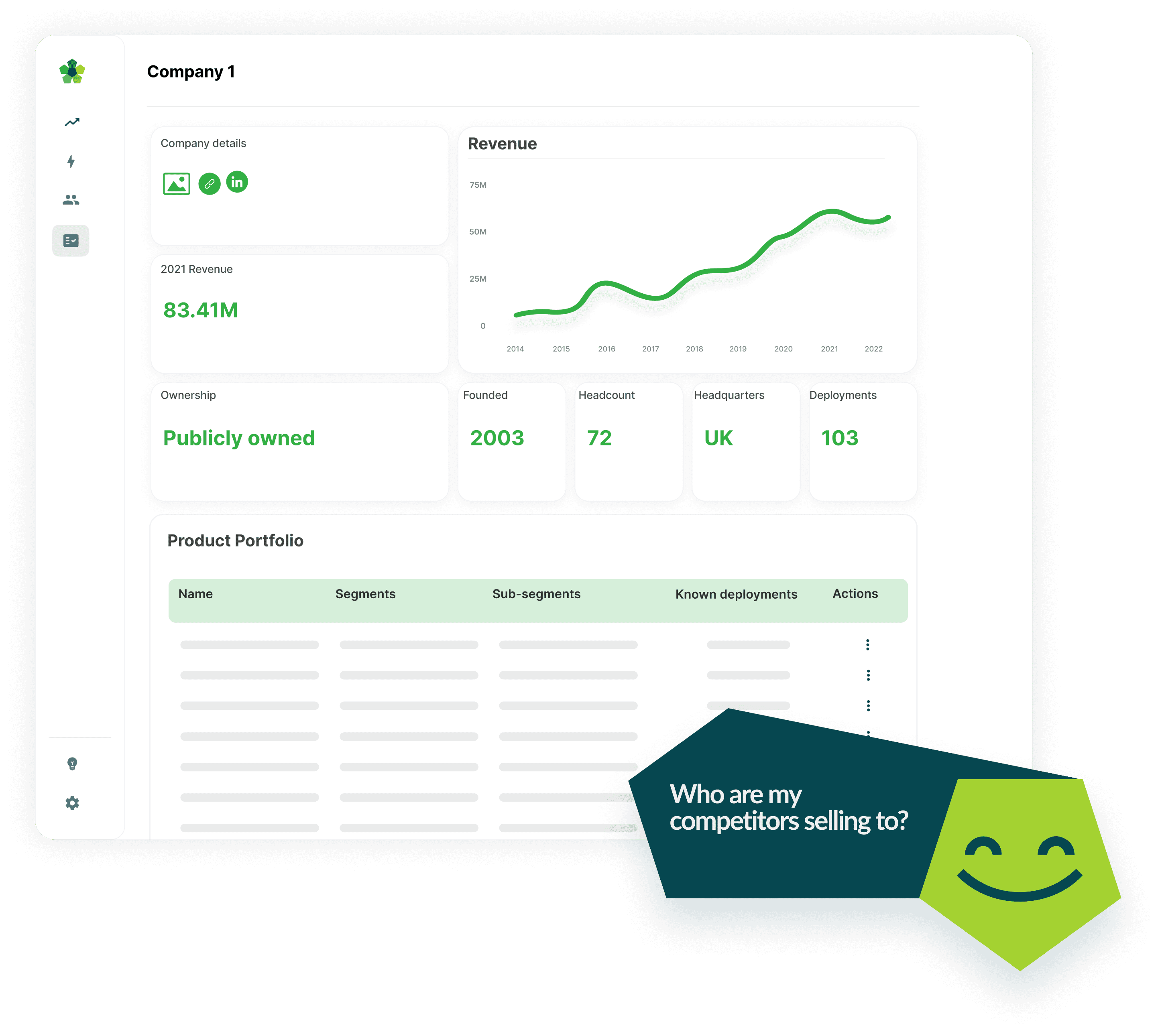

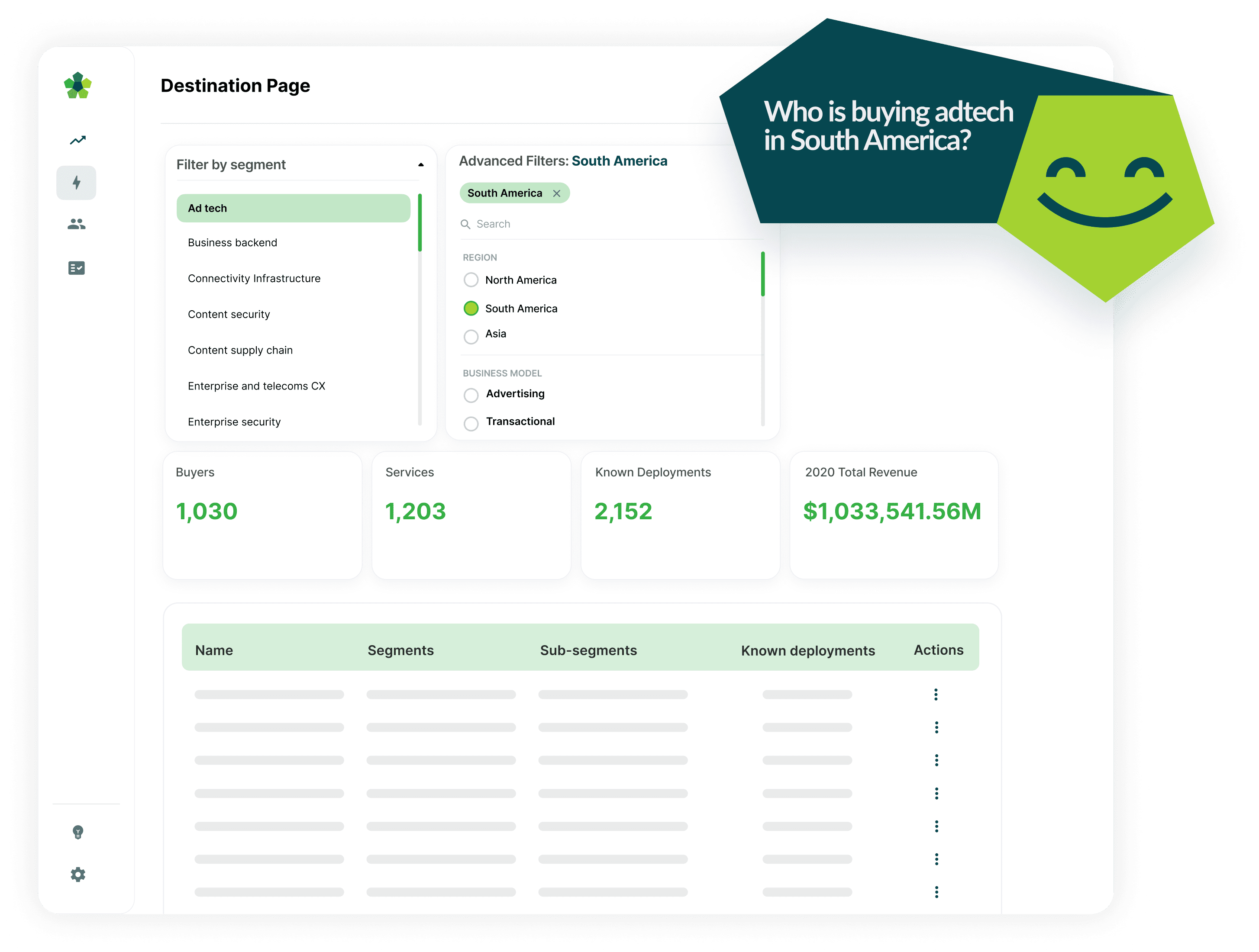

Providing the most detailed media tech deployments market data available with unmatched competitor information, broadcast and media technology market sizing, product revenues and market shares.

Sales enablement

Empowering business development with tools to identify the market opportunity and manage account planning. Understanding buyer cohorts, addressable markets and navigating key risk factors.

Vendor shortlisting

Speeding time-to-market for new technology deployments and reducing procurement cycles with instant access to our leading database of vendors, their products and deployments.

Vendor selection

De-risking technology decisions with access to transparent information about which products are actively being deployed by similar buyers, and vendors’ company track record and financials.

Market trends

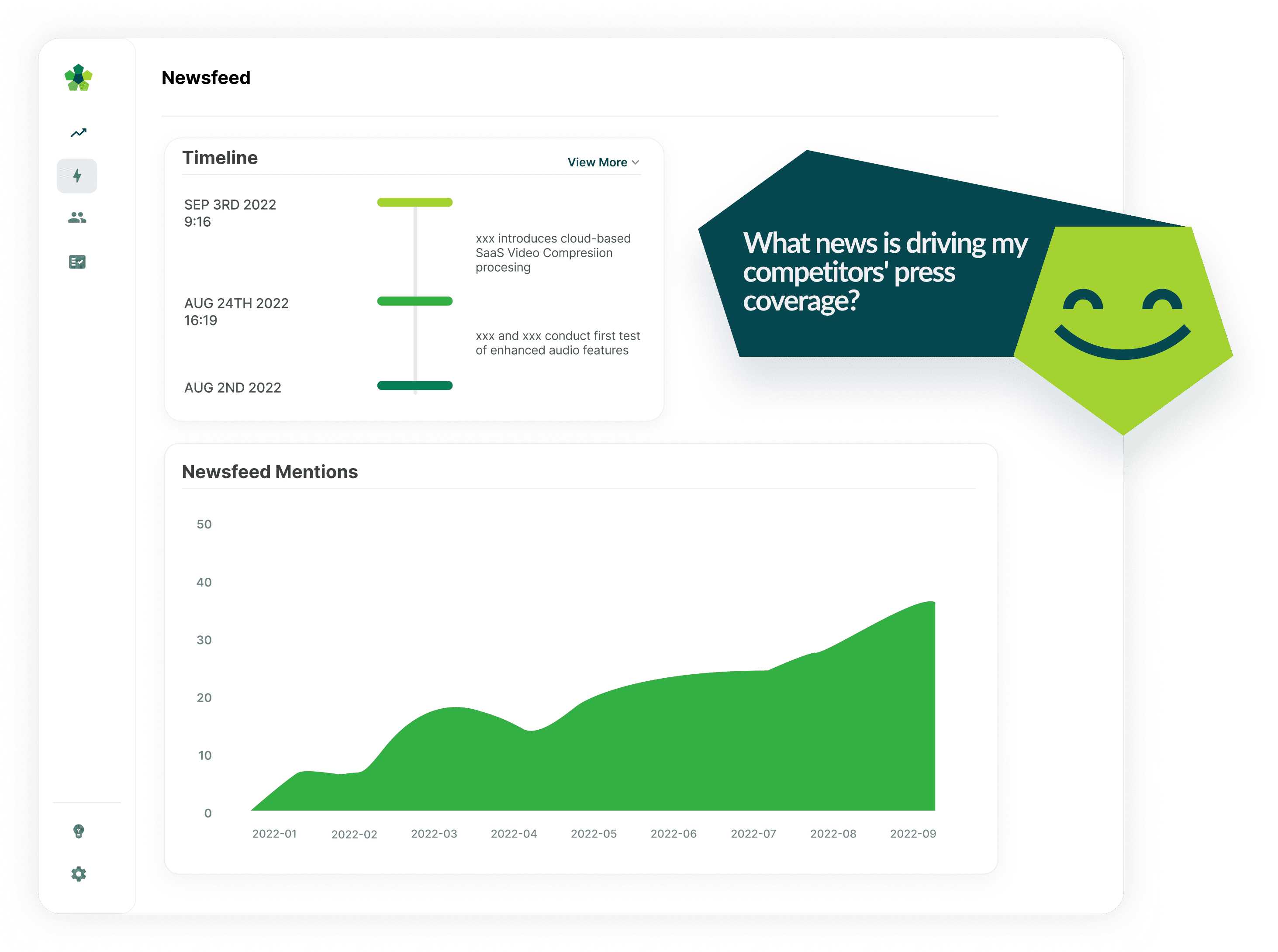

Identifying where to invest and which projects to prioritise with access to curated industry news and analysis of key trends, reports and webinars, gathering all the key information in one place.

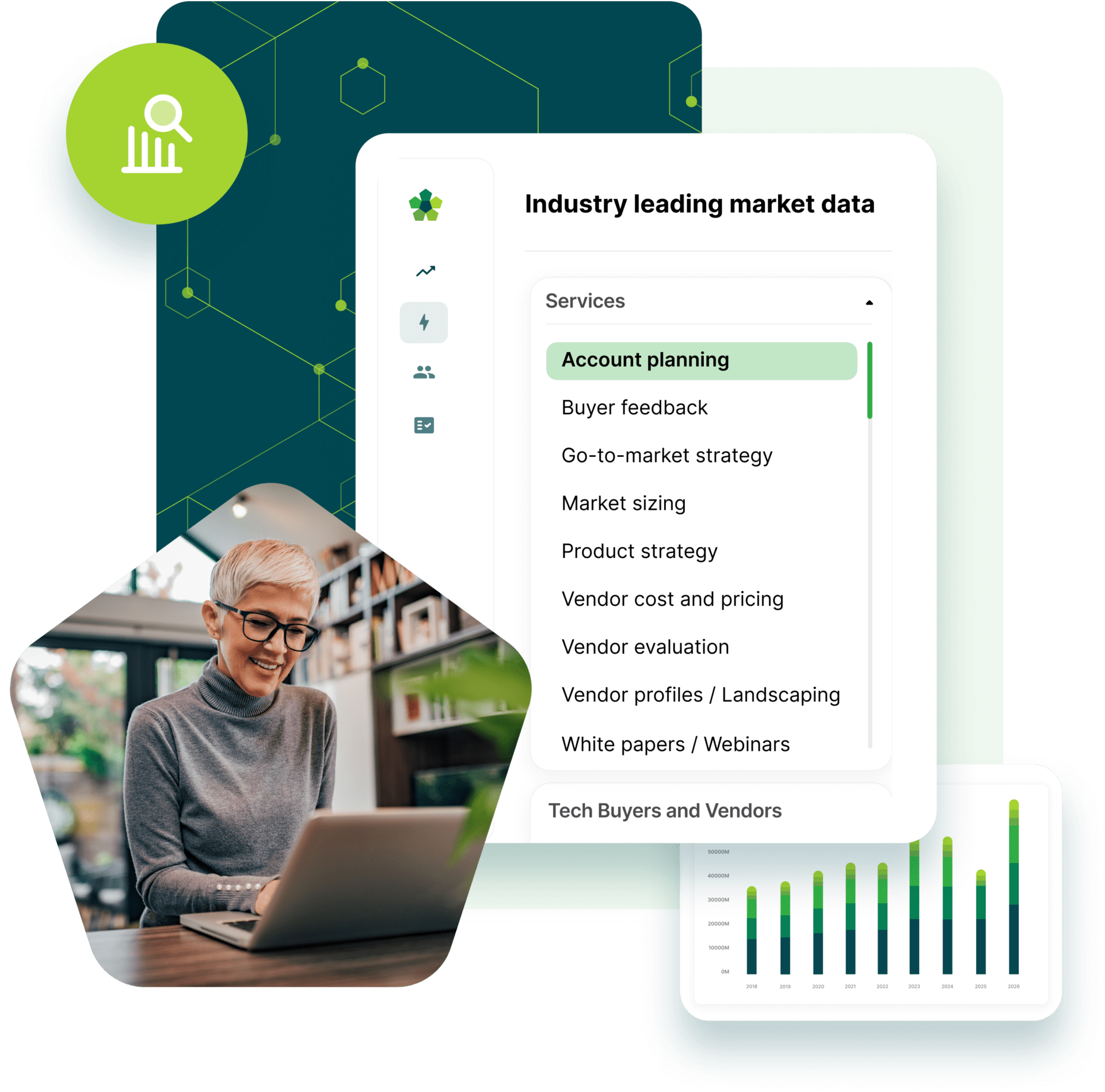

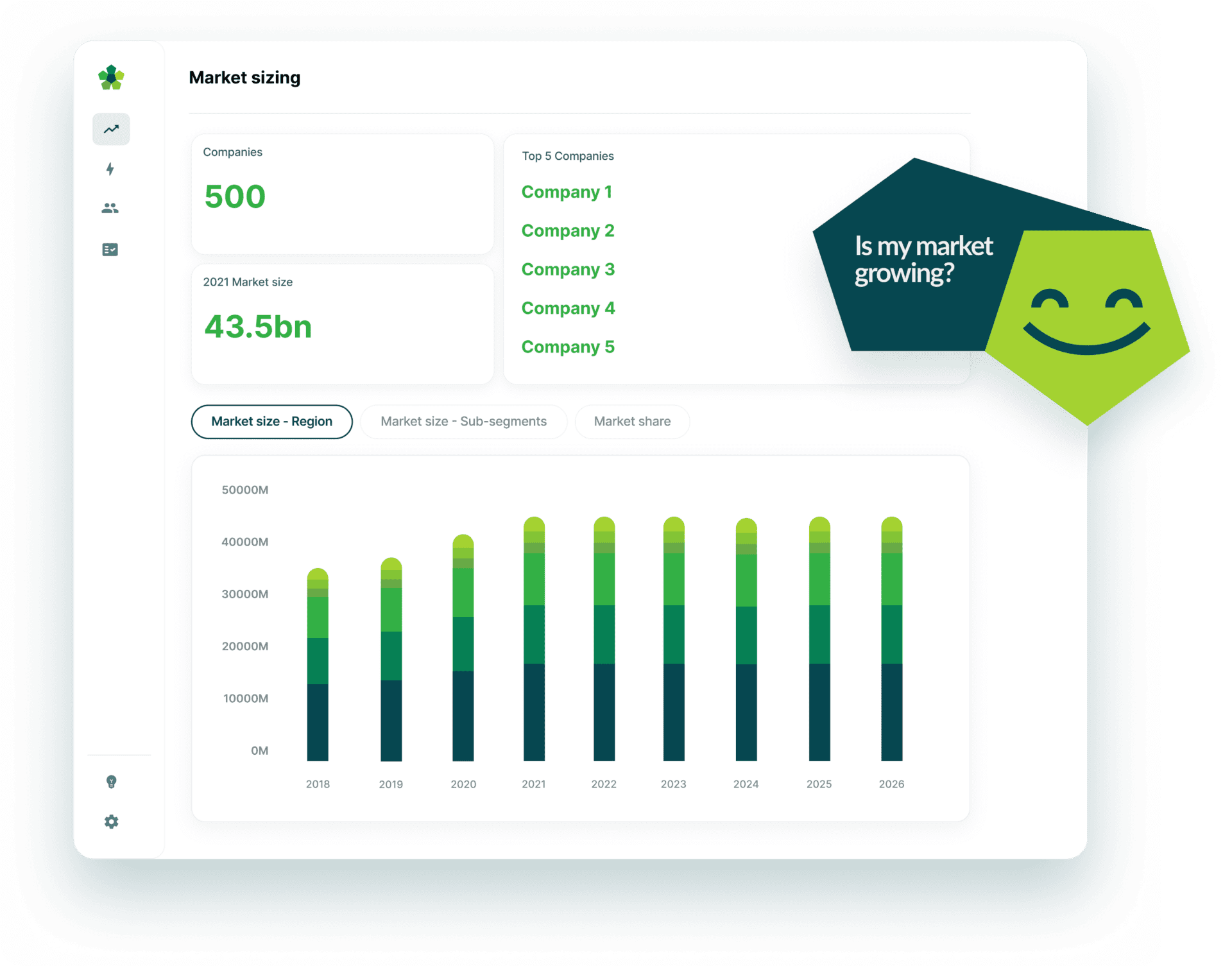

Caretta Portal

Caretta Portal is the most detailed and usable database available for buying, selling and marketing broadcast and media technology. It offers technology buyers and vendors unmatched insights into the industry, presenting real world data in a comprehensive and accessible digital platform.

Insight

Gain unparalleled and granular insight into the media technology industry. Broadcast and media technology market sizing, forecasting and market share data across over 100 technology segments and growing.

Understanding

Never miss an opportunity. We provide unrivalled understanding of the participants in the media technology industry with our growing and comprehensive database of over 7,000 companies with key metrics.

Strategy

Quickly answer key strategic and tactical questions around competitors, partners, suppliers and buyers. The user-friendly interface and intuitive data structure simplify and accelerate complex research tasks.

Current

Stay up to date. Our expert team of analysts update the portal daily and curate the latest news to make sure our clients remain on the cutting edge.

Case studies

Our expert team of analysts use real world information to help vendors prioritise which companies they should sell to and why. This information is delivered through a detailed strategic plan focused on winning them over, retaining them, and developing relationships.

The Caretta Research team can provide unmatched market insights into the media technology industry for both buyers and vendors, which include market sizing, forecasting, and market share data over across 70 technology segments and growing to ensure that your next industry move is the right one.

The Caretta Research Team can deliver thorough and efficient product strategies. From the original process of uncovering market demands and forecasting success to creating a plan that empowers the sales organisation and effectively positions and communicates new products within the market, our team will be by your side every step of the way.

What people say

Trish Macrae @ Nielsen

"I wanted to work with someone who could quickly grasp the nuances of our metadata deployment with a major multinational pay TV operator and who could translate the benefits into something digestible yet compelling for a non-techie audience. It was also important to work with a company with the credibility and professionalism to deal with an important commercial relationship for us. Caretta Research certainly ticked these boxes and they knew what they were talking about when it came to media technology. Rob Ambrose and his team were easy to work with, responsive and communicative and most importantly they delivered what they promised on time."

George Bevir @ IBC

“The IBC team enjoyed working with Rob Ambrose and his colleagues from Caretta Research to produce the workflow tours and webinars over 2021: their industry knowledge and network were crucial in attracting the right guests to appear in the films and in ensuring they were asked the most relevant questions. They were a pleasure to work with, proactive and flexible throughout a long production schedule, and ultimately their efforts helped us attract the sponsors and partners we wanted to work with.”

Merrick Kingston @ Synamedia

"What we like about Caretta Portal is that it's got everything in one place, so I know that if I go into a technology segment or subsegment I am mutually excluding everything else in the industry. I just can't do this with other datasets. It's usable, it's modern."

Robin Kirchhoffer @ Dalet

"We use the data platform, Caretta Portal, to reinforce and accelerate a number of functions in our business particularly around competitive intelligence and identifying market opportunities."

Kelvin Jones @ DPP

“Caretta Research provided us with the data we needed to support our membership acquisition strategy. We also gained key insights into the methodology that enables us to continue similar research internally. It was a beneficial collaboration and we look forward to working with Caretta again in future.”